New Zealand Association of Accredited Employers (NZAAE) Submission to ACC on 2014/2015 Levy Consultation.

- By admin

- •

- 06 Jun, 2016

- •

Introducing the NZAAE

The NZAAE is an incorporated society comprised of employers who manage their ACC claims through the Partnership Discount Programme (PDP) or the Full Self Cover option under the Accredited Employer Programme (AEP). The NZAAE includes members who are not Accredited Employers but have an interest in the programme such as Third Party Administrators, Actuaries, and insurers. Our members collectively employ over 130,000 full time equivalent employees.

The NZAAE provides a united voice for our members so that our interests can be represented to ACC and the Minister. We also maintain a close relationship with similar groups in Australia because there is much that can be learned from the Australian experience of self insurance.

Discussion

After full review of the 2014/2015 Pricing Report and Levy Consultation Documents, as well as previous years Consultation Documents (excluding 2011/2012) NZAAE would like to make the following observations.

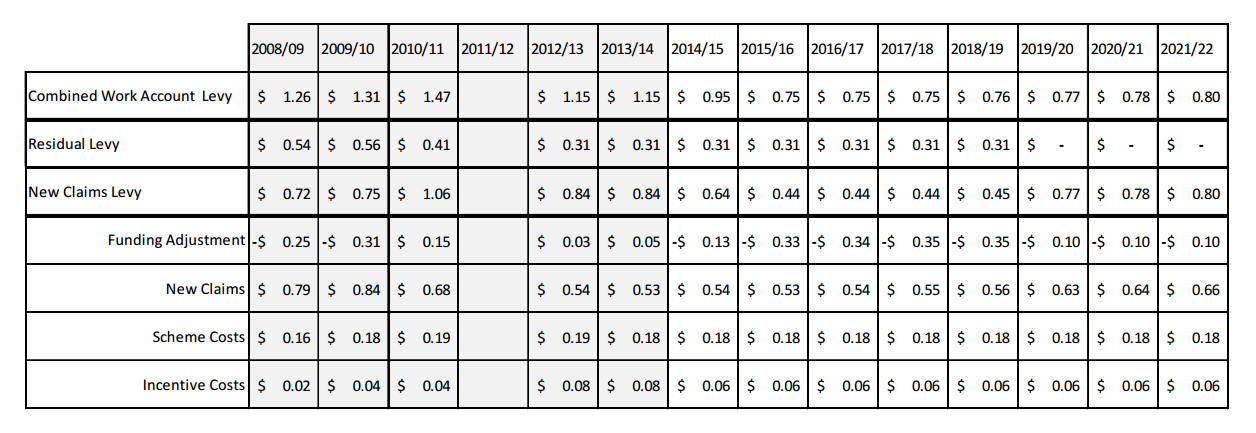

Table 1 below indicates the effect of the residual levy and funding adjustments of the past six years and uses information provided by ACC and best estimations on future years projections. (Data from 2011/2012 was not examined but has been included for completeness).

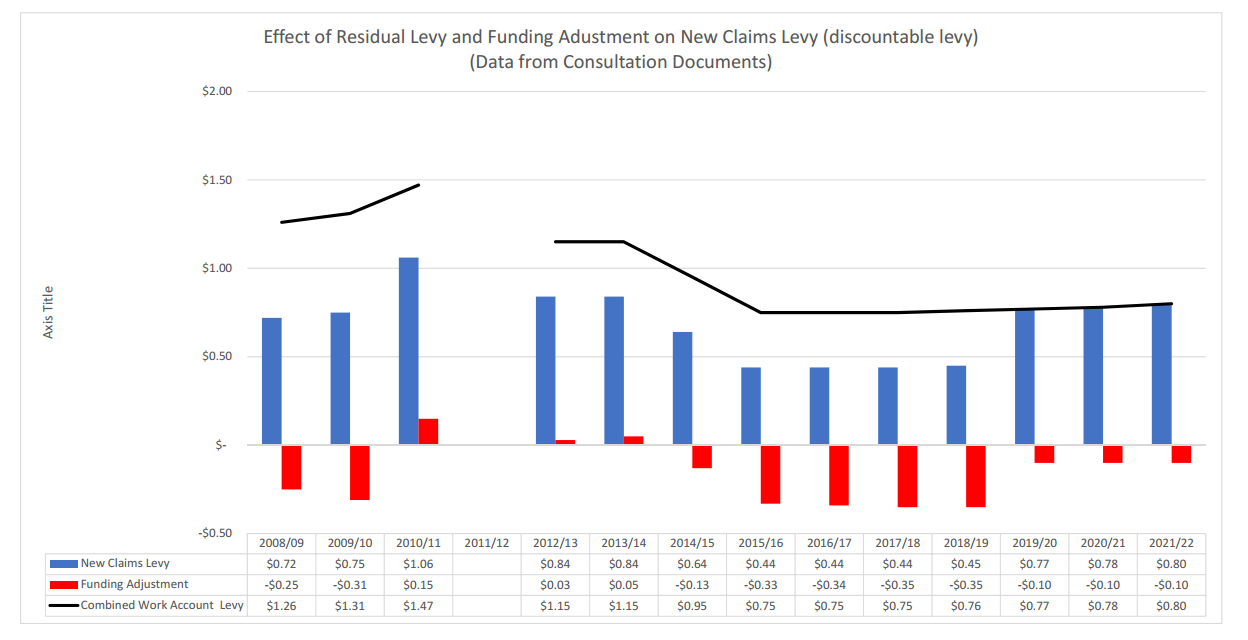

Graph 1 indicates the comparative difference between funding adjustment and residual levy collection as it is expressed in the combined work account levy. The New Claims Levy collects the fully funded levy for claims incurred in the year it is collected. It is important to note that it is only the New Claims Levy that is discountable for levy incentive purposes for the Accredited Employer Programme.

Table 1: Levy Consultation Data from 2008 to 2022 (2011/12 data not available)

The NZAAE is an incorporated society comprised of employers who manage their ACC claims through the Partnership Discount Programme (PDP) or the Full Self Cover option under the Accredited Employer Programme (AEP). The NZAAE includes members who are not Accredited Employers but have an interest in the programme such as Third Party Administrators, Actuaries, and insurers. Our members collectively employ over 130,000 full time equivalent employees.

The NZAAE provides a united voice for our members so that our interests can be represented to ACC and the Minister. We also maintain a close relationship with similar groups in Australia because there is much that can be learned from the Australian experience of self insurance.

Discussion

After full review of the 2014/2015 Pricing Report and Levy Consultation Documents, as well as previous years Consultation Documents (excluding 2011/2012) NZAAE would like to make the following observations.

Table 1 below indicates the effect of the residual levy and funding adjustments of the past six years and uses information provided by ACC and best estimations on future years projections. (Data from 2011/2012 was not examined but has been included for completeness).

Graph 1 indicates the comparative difference between funding adjustment and residual levy collection as it is expressed in the combined work account levy. The New Claims Levy collects the fully funded levy for claims incurred in the year it is collected. It is important to note that it is only the New Claims Levy that is discountable for levy incentive purposes for the Accredited Employer Programme.

Table 1: Levy Consultation Data from 2008 to 2022 (2011/12 data not available)

Graph 1: Effect of Residual Levy and Funding Adjustment on New Claims Levy

Review of Table 1 and Graph 1 raise major concerns for NZAAE.

Implications

- The configuration of the Work Account which combines both the Residual Levy with the New Claims Levy distorts and acts as a disincentive for safety and wellbeing performance by employers and involvement in the Accredited Employer Programme.

- This disincentive is occurring because the ACC Amendment Act 2010 has fixed residual levy collection as $0.31 per $100 of liable earnings until March 31st 2019.

- It is our understanding that the Ministerial determined amount set for collection in the Residual section of the Work Account is $3,404,206,000.

- It is worthy of note that in 2016 whilst $0.31 is to be paid by employers for residual levy, the negative adjustment of $0.33 suggests an over collection by ACC for Residual Levy.

- The collection of $0.31 raised in point 4 is proposed to be repeated by ACC until 31 March 2019, see Table 1.

- Regarding point 4 and point 5 we note that collection of residual levy in fact either wholly or partially subsidises the full funded liability of the New Claims section of the Work Account.

- If point 6 is correct then ACC is in fact making funding adjustment of the New Claims section of the Work Account rather than the Residual section of the Work Account.

- If this is so, it suggests that the $3,404,206,000 residual liability is near being fully funded and that Residual Levy is being collected to fund future liability of New Claims more than the Residual Claims.

- If point 8 is correct then employers are being prevented from all new claims liability being subject to health and safety performance incentives, experience rating calculations and that Accredited Employers are funding future claims liability for which they have limited or no liability (i.e. such liability is covered Stop Loss and PDP aspects of the AEP Levy).

- Finally, if point 9 is correct then Full Self Cover Accredited Employers are being prevented from the full value of their New Claims Liability being factored into levy adjustment as per the Act, Regulation and the AEP Framework. This is worsened when, despite paying ACC for New Claims Liability through Residual Levy contribution, they are required to compulsorily

- pay Stop Loss cover which is more than likely already funded through the non-discountable residual levy.

- Evidence of the distortion supporting point 10 can be seen in Table 1 where New Claims Levy values are less than the expected new claims costs.

- In the early years of the Accredited Employer Programme, the driver to be involved was to reduce the cost of levies but there are now more motivators for employers to be involved in the Accredited Employer Programme. Once in the Accredited Employer Programme, safety practitioners realised that the annual audit procedures kept the organisation focussed and some organisations found that the claim management skill set could be expanded into wellbeing programmes. The proposed levies in the 2014/15 consultation significantly put at unnecessary risk the successful gains achieved over the last 14 years of the ACC Accredited Employer Programme.

- The simple solution is an ACC policy decision allowing the residual levy to be included in the discountable value of the Work Account Levy.

- The NZAAE believes that section 169 AA (1)(a) provides for ACC to cease charging a Residual Levy if the amount that has been specified by the Minister has been met. There are indications in the consultation documents that this in fact the case.

- A more difficult solution is an ACC policy interpreting the ACC Amendment Act 2010 to refer to the one value identified by the Ministerial decision as an aggregate amount rather than $0.31 per $100 of liable earning. This being the case ACC can determine the extent to which the requirement of Act has been achieved and thereby reduce the rate per $100 to reflect what is need in the Residual section of the Work Account compared to what is needed in the New Claims section of the Work Account. It is further recommended that ACC disclose the amount that is being collected for the Residual Levy as part of the levy consultation process.

- The most difficult solution is for Government to evaluate the level of achievement regarding the collection of the $3,404,206,000 and determine that the requirements of the Act have been fulfilled and allow ACC to adopt recommendation 2 and/or 3.

Implications

- If ACC and Government do not address the issues raised here it is likely that when ACC levies are being considered for incentives for the ‘Working Safer’ blueprint, that the issues raised above will be a major impediment to meeting the Government’s objectives around safety.

- If ACC and Government adopt the proposed levy rates Accredited Employers will be financially marginalised unnecessarily. Given that up to 40% of their discountable levy is denied to them, the materiality of economic involvement is erroneously diminished because of structural complications between the Residual Levy and the New Claims Levy in the work account. This impediment is clearly demonstrated in consultation documentation showing massive in discountable levy between 2019 and 2010. Refer to Table 1.